Primacy:

Customer behaviour that indicates loyalty to a bank through adoption and use of several products and services – such as a checking customer who is also a card holder, has direct deposit and uses the mobile tool.

Personalisation:

Recognition of an individual, determination of the right message and presentation of that message, wherever the individual is.

Situation

Banks have had articulated goals around both primacy and personalisation for years. It’s a well-known fact that a primary customer can be many times more loyal and valuable than a non-primary customer. The banking relationship is much harder to disrupt, the more embedded a customer is with a bank.

However, creating those relationships has been elusive and typically approached through the lens of product acquisition. And those acquisition efforts have been personalised in only the most rudimentary way – using name, address and sometimes (but surprisingly seldom) other data such as product usage, product relationships, etc.

It’s not that marketers aren’t trying. But whether the barrier is data silos, data movement or lack of confidence in the quality and depth of data, there are challenges to executing fully personalised strategies. Ironically, customers expect their banks to know them better than almost any brand – and yet banks often hardly acknowledge the relationship, let alone speak to their customers as if they understand the full scope of their relationship.

The journey is the point

Marketers use words like “journeys” to explain how people interact with brands. They also talk about the “funnel” and divide tactics by “top of the funnel”/awareness, “mid-funnel”/performance and “bottom of the funnel” conversion. But the explosion of signals and channels has meant buying and shopping and research behaviours are no longer “linear,” with people moving up and down the funnel during the buying process.

People today may emit buying signals by clicking on an ad but then spend weeks doing comparison research before visiting the brand’s site and filling out an application. They will have interacted via mobile device, desktop, tablet and work desktop, clicking ads and visiting sites and social media pages. All these interactions are opportunities for the brand to recognise them, determine a message and present that message.

Each interaction emits a digital signal. But who sees the signals? The answer is nobody unless the signals can be pulled out of the channel or app silo and into a “customer intelligence framework.”

Primary customers will be happier customers but only when you know them

Imagine a scenario where a bank uses insights about a customer to deliver solutions when the customer needs them, cultivating a sense of trust, loyalty and financial wellness. This translates into more profitability and longer customer tenure for the bank – a classic win-win.

But in truth, converting all the raw data available to banks into insights about customers is the hard part.

Raw data generated by a customer interaction can live in apps, in channels, in product lines, in marketing and enterprise databases. There are often several versions of the customer relationship, none of which are the complete truth. This challenge could be replicated across business lines and channels such as branch, call centres and product lines.

Using this raw data to personalise communications can lead to a disjointed and confusing narrative for customers, who are probably wondering why the bank doesn’t seem to know them. The miss is often as simple as an existing credit card holder getting an offer for the same card or a checking customer being offered a home equity line of credit when the customer doesn’t own a home. Getting those two scenarios right comes down to having the tools to turn data into insights.

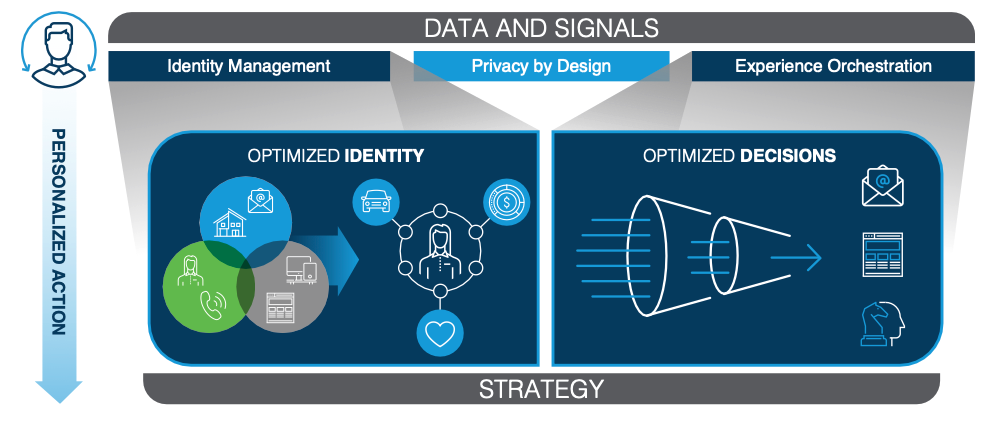

The Customer Intelligence Framework

The customer intelligence framework is made up of technology, data and strategy. To be successful, a bank needs to look at all three elements:

Technology:

Optimised identity

Identity resolution is a process by which people’s signals are collected in a centralised repository at the individual level. Data indicating life changes – moving, getting married or divorced, and other details can be tied together to build a more complete view of a person. Newest thinking on identity is that people’s digital profiles should be as robust and vital as their offline profiles and should be stored and managed compliantly within a first-party identity graph.

Clean and complete data when resolving identity gives marketers the best chance of reaching people where they are now. This isn’t just a point-in-time solution, it is the backbone of the modern marketing technology stack and critical to orchestrating good, personalised experiences.

Optimised decisioning

Decisioning is a combination of business strategy and technology. It’s choosing the right message for the individual and activating that message. Most commonly the tools used to execute decisioning are a combination of real-time data stores housing offer databases, and customer data platforms, or CDPs.

The decisioning tool is fully integrated with the identity graph, ensuring accurate recognition and activation.

Data:

The identity solution can accommodate offline and online data and can also be informed by third-party marketing data, CRM data and other enterprise data. Ideally these disparate data sources will be integrated and stored in a repository that can be accessed for campaigns.

Strategy:

Strategy in this context is the focus on creating personalised, relevant and valuable experiences for the customer and the brand. It starts with developing top use cases, understanding the desired outcomes and behaviours that will deliver business results for the brand, while creating loyal customers. Personalisation should be additive to customers’ experience with the bank; it should make them feel known, and ideally, understood. Too often banks prioritise product sales over good customer experiences; if they focused on experiences, product sales would naturally occur.

Banks need to ensure their customer intelligence strategy delivers on three key objectives that, when met, will create better customer experiences and more loyal primary relationships:

- Provide a consistently delightful experience in every interaction channel, whether digital, mobile, call centre or branch

- Deliver personalised and contextual experiences

- Be preference-driven

- Focus on customer lifetime value

- Understand the unique needs of customers at each stage and message accordingly

- Show you know them by delivering relevant messages at each interaction

- Take advantage of every interaction

- Be purposeful in servicing messaging

- Quickly identify site visitors

- Leverage data and technology to build robust customer profiles

- Take advantage of every interaction

- Be purposeful in servicing messaging

- Quickly identify site visitors

- Leverage data and technology to build robust customer profiles

How to get started

Building a comprehensive customer intelligence framework can seem daunting. In fact, it may make sense to start with a single use case, such as identifying site visitors

or enabling bank tellers to make the next best offer to a customer. Even starting small, marketers will need to make sure they’ve considered the technology, data and strategies involved to make the use case work.

Conclusion

Personalisation and primacy are goals and key performance indicators banks track. We know these are top of mind because we see them stated in public earnings materials. With a customer intelligence framework in place, banks can begin to leverage insights to create great personalised experiences for people interacting with their brand. Better experiences drive loyalty and propensity to consider additional products and services. In short, they create primary customers.